Ask for it at the one-off price of 14.90 Euro (without fee and credit package) or click here to receive it for only 3.50 Euro with the Subscription formula, free trial for 3 days then, 49.90 Euro per month and 200 credits with which you can download up to 14 budgets per month.

Please note that Registrovisure.co.uk is a service reserved for companies, freelancers and VAT payers.

RegistroVisure offers you:

Dedicated Customer Support

An operator available by e-mail Monday to Friday from 9 a.m. to 6 p.m. and responding within 10 minutes

Tutorials and guides so you don’t get lost in bureaucratic procedures

Guides to help customers in many administrative and bureaucratic fields

The company balance sheet is a comprehensive and in-depth information tool on the economic and financial status of a company. It is a set of accounting documents drawn up periodically that attest to the balance sheet situation and make it possible to analyse the corporate structure of a company. The annual balance sheet consists of the profit and loss account, the balance sheet and the notes to the accounts with the relevant minutes of the shareholders’ meeting of the company sought. Only corporations are obliged to file them, namely

Limited liability companies;

Joint-stock companies;

Limited partnership limited by shares;

Cooperative company;

Foreign companies based in Italy;

G.E.I.E;

Consortia qualifying as confidi;

Consortia that do not qualify as confidi are required to file only the balance sheet;

Enterprise Network Contracts;

Special Companies and Institutions of Local Authorities;

Innovative start-ups.

The annual financial statements are the set of accounting documents that a company must draw up periodically, in accordance with the law, in order to pursue the principle of truthfulness and to clearly, truthfully and correctly ascertain its equity and financial situation, at the end of the administrative period of reference, as well as the economic result of the financial year itself.

The balance sheet is a document consisting of three parts:

Balance Sheet

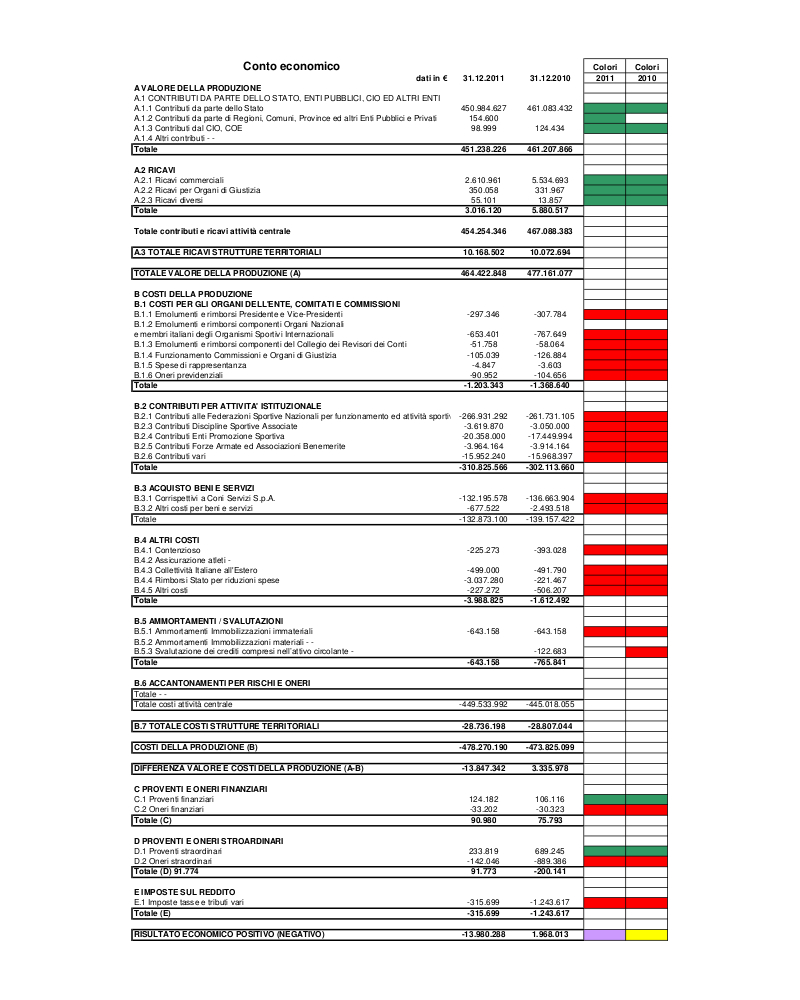

Profit and Loss Account

Notes to the accounts

The BALANCE SHEET represents the company’s situation at the end of the financial year: this statement must show the company’s assets, liabilities and financial situation and, as the difference between the two, the shareholders’ equity. The balance sheet is divided into two sections: assets and liabilities.

Assets – All assets and property owned by the company (buildings, machinery, equipment) used in the operation of the business, the company’s receivables from third parties (customers, etc.), cash and cash equivalents (cash, current account balances).

Liabilities – the company’s debts to third parties (suppliers, banks, …). Equity indicates the company’s ideal debt to its owners, and consists of reserves and share capital.

The INCOME STATEMENT provides information on the economic situation of the company by indicating the costs incurred and the revenues earned by the company during the financial year: the difference between costs and revenues gives the profit or loss for the year. The linking element between the profit and loss account and the balance sheet is the profit for the year (or loss) which, if not distributed to shareholders, will become part of the company’s assets as part of the shareholders’ equity.

The INTEGRATIVE NOTE is a document that is an integral part of the financial statements: it must contain all the information that allows a more truthful and correct representation of the patr